By Krivith Reddy – Federal Account Manager, Connection

(Views expressed are my own.)

1. Introduction

In the world of virtualization and cloud infrastructure, one vendor has been foundational to how many federal agencies build their data centers: VMware. When Broadcom acquired VMware, it triggered a sweeping shift in licensing strategy—from the familiar perpetual license model (buy once, own forever) to a subscription-only model (term licenses with recurring payments).

For federal agencies, this shift is more than an IT procurement detail. It affects budgeting, procurement strategy, audit/compliance risk, vendor lock-in, and long-term migration planning.

According to industry analyses, VMware’s transition eliminated new perpetual licenses and forced many customers into subscription licensing for vSphere, vSAN, and NSX. (Stormagic)

2. What Exactly Changed?

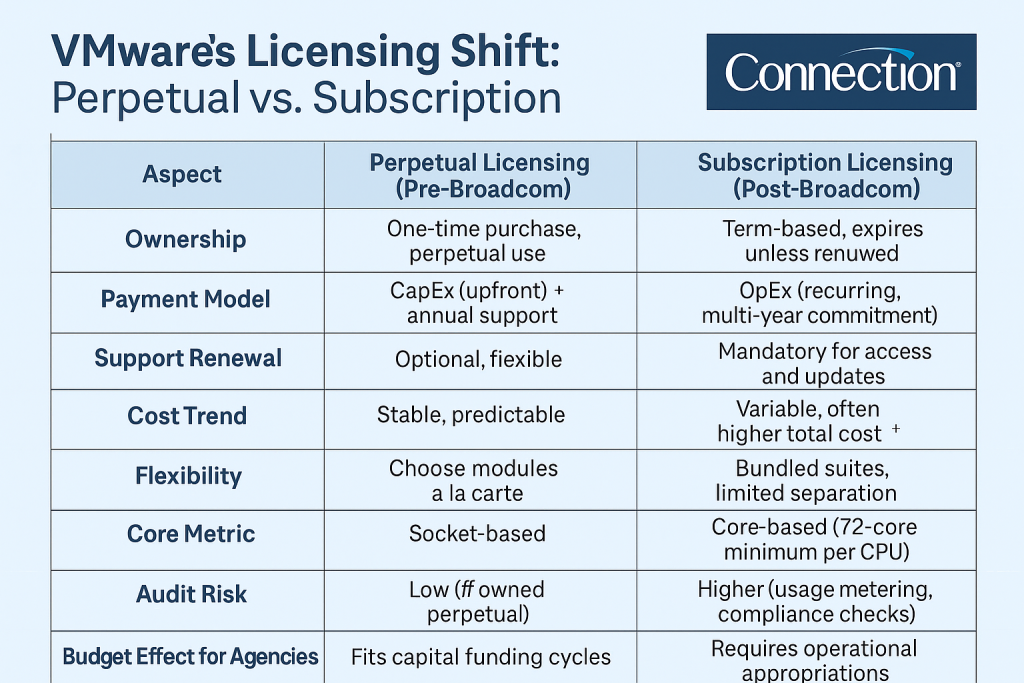

Here are the core structural licensing changes that federal agencies must understand:

- End of perpetual licenses: VMware ceased new sales of perpetual licenses for core products like vSphere, vSAN, and NSX, moving entirely to subscription-based or term licenses. (Broadcom Negotiations)

- Increased minimum cores: Broadcom raised the minimum core requirement per license (from 16 to 72 cores), dramatically changing how customers calculate their entitlement. (CRN)

- Fewer SKUs, more bundles: Many previously standalone VMware modules are now bundled, limiting customer flexibility. (Schneider IM)

- End of support renewals for perpetuals: Older perpetual licenses can continue to run, but support and updates now require migration to a subscription model or a third-party support provider. (Redress Compliance)

- Budget category shift: One-time CapEx investments become ongoing OpEx commitments — changing how agencies plan and fund virtualization workloads.

Visual: Perpetual vs. Subscription Licensing

3. Why This Matters for Federal Government Workloads

Federal agencies operate under unique conditions: rigid fiscal cycles, acquisition regulations, compliance frameworks (FedRAMP, FISMA, DoD STIGs), and mission continuity mandates. VMware’s licensing transformation directly touches all of these.

a) Budgeting and Funding Impacts

Agencies must now plan for recurring operational costs rather than one-time capital purchases. Under Broadcom’s new structure, multi-year subscriptions can significantly increase total cost of ownership. Some estimates suggest pricing increases of 150% – 1,200% depending on environment size. (DXC Technology)

This shift requires updated budgeting workflows and potentially new appropriations models to align with recurring cloud-style expenses.

b) Procurement and Contract Risk

Changes in licensing metrics (e.g., sockets → cores) mean agencies may now pay for unused capacity.

Questions to consider:

- Are legacy federal VMware contracts grandfathered in?

- Can agencies negotiate transitional credits?

- What happens if Broadcom audits core counts under new metrics?

Broadcom has also introduced renewal penalties (up to 20% of first-year subscription cost) for late renewals, creating potential compliance pressure. (CRN)

c) Vendor Lock-in and Migration Pressure

Many agencies have deep VMware integration—vSphere for virtualization, NSX for networking, and vSAN for storage. Moving off that stack is complex. Still, the pricing changes have led some customers to evaluate multi-hypervisor or hybrid cloud architectures for flexibility and cost control.

Key question: Does the mission justify staying, or does it justify diversifying?

d) Audit and Compliance Exposure

Subscription licensing introduces usage metering and true-up requirements that perpetual customers never faced.

Federal IT leaders must ensure:

- Accurate license inventories

- Central tracking of CPU and core counts

- Proactive audit readiness to avoid surprise “compliance bills”

4. Key Questions Federal IT Leaders Should Ask

- What VMware licenses do we currently hold (perpetual, term, subscription)?

- Are renewal timelines aligned with fiscal-year cycles?

- Are workloads appropriately sized under the new core metrics?

- Does our procurement vehicle (GSA, SEWP, etc.) allow for negotiation or exemptions?

- Do we have a costed roadmap for potential migration or hybridization?

- What are the implications for compliance, especially under FedRAMP or DISA frameworks?

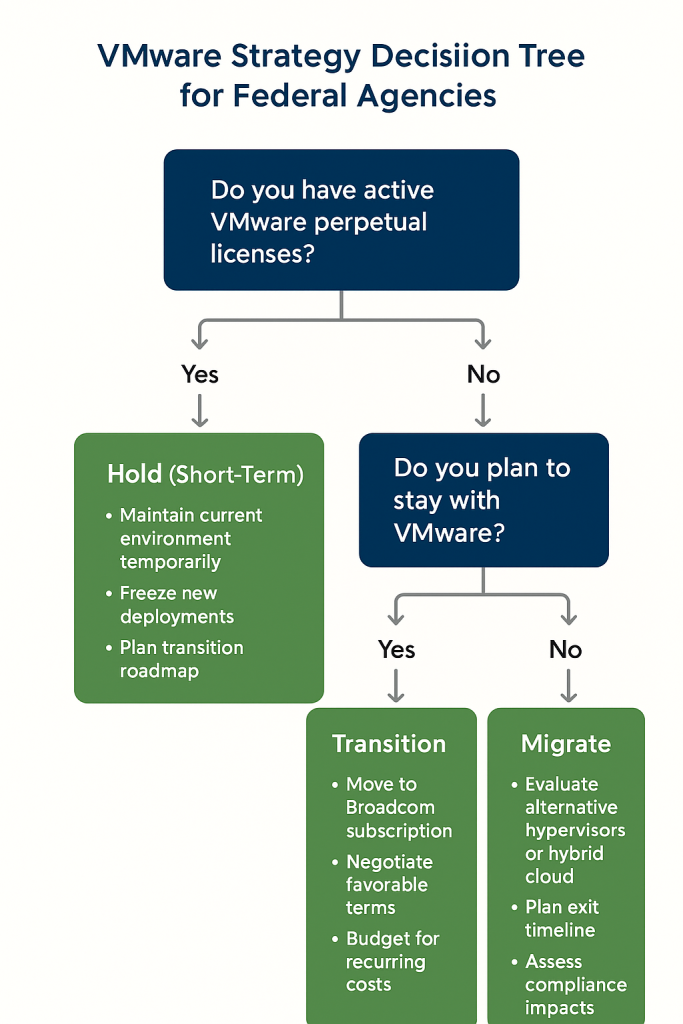

5. Visual: “Stay, Transition, or Migrate” Flow

6. What Connection Can Offer Federal Agencies

As a Federal Account Manager at Connection, I help agencies navigate technology shifts like this through:

- License audits and impact assessments – Identify current entitlements, usage, and renewal terms.

- Cost modeling – Compare “stay,” “hybrid,” and “migrate” scenarios with cost, risk, and mission impact.

- Negotiation support – Use Connection’s relationships with vendors to secure better transition terms and pricing protections.

- Migration readiness planning – Explore alternative hypervisors or hybrid-cloud models that maintain compliance.

- Governance and audit readiness – Implement monitoring to prevent non-compliance and unexpected audit exposure.

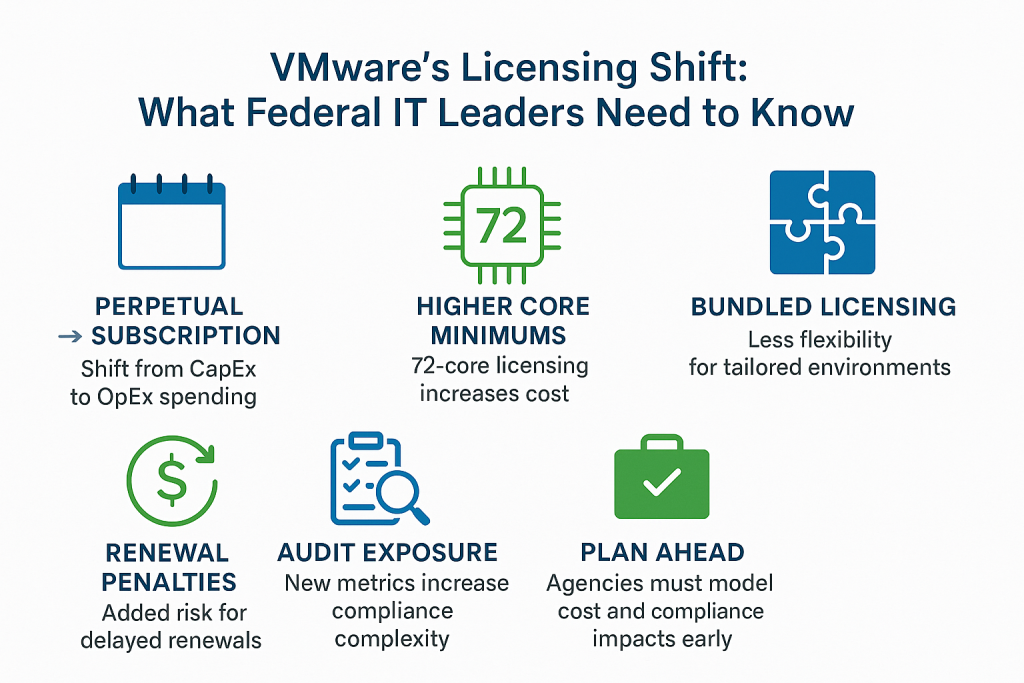

7. Visual: Key Takeaways Summary

8. Conclusion

The Broadcom–VMware licensing shift isn’t just a pricing update — it’s a strategic inflection point.

For federal agencies, it affects budget cycles, contract planning, and mission continuity.

By assessing current licenses, modeling cost impacts, and engaging in proactive negotiations, agencies can stay compliant, cost-effective, and mission-ready.

At Connection, our goal is to make that process transparent and actionable. Whether your agency chooses to stay with VMware, adopt a hybrid approach, or migrate to alternatives, the key is to act before renewals lock you in.

The license you signed five years ago doesn’t guarantee the cost you’ll pay next year.

Sources

- Stormagic: VMware Licensing Changes Explained

- Broadcom Negotiations: VMware Licensing Changes Under Broadcom

- CRN: Broadcom VMware Ups Minimum Core Purchase

- Schneider IM: VMware by Broadcom Portfolio Simplification

- Redress Compliance: VMware Licensing and Subscription Changes Explained

- DXC Technology: VMware Licensing Changes and the Road Ahead

- Reuters: EU Questions Broadcom on VMware Licensing Changes